- What is a lender Report Home loan?

A bank statement home loan is actually a unique sorts of mortgage you to lets the newest homeowner so you’re able to qualify for home financing and borrow funds based on only the property within family savings rather than merely its month-to-month or annual income. The sort of https://paydayloancolorado.net/brook-forest/ financial are popular with small enterprises or most other borrowers that have enough possessions although not a good lot of cash circulate. Specifically, anybody who doesn’t discovered W2 income otherwise much time-label and you can uniform 1099 income may wish to look if or not a financial statement home loan is good for them (instance business owner mortgages).

Bank statement mortgages are among the top implies to possess short advertisers, self-working people, and you can a property investors to discover the investment they need to get a house. When you find yourself considering taking a lender report mortgage, you really has actually enough questions relating to this type of lenders, like how exactly to be considered and just how long it will require to close towards financial. While they’re not a quite common method regularly pick a house, these types of mortgages have been around for decades.

Financial declaration financial programs may be used from the anybody, however they are mostly utilized by folks who are notice-functioning. In lieu of render all paperwork needed to ensure earnings getting a corporate, self-operating borrowers may use these fund so you’re able to forget about numerous the newest records they might if you don’t must gather along with her under control to acquire a mortgage.

All it takes to own a financial statement financial?

Private bank comments are critical, naturally, but borrowers might also be asked to incorporate most other records to ensure its identity into the pursuing the variety of data:

- Confirmation out of most other a home holdings and car. This might wanted variations including headings.

- Verification of one’s possession out of organization assets. This might otherwise may not be needed, it constantly is based out of on age and you will balance of the company.

- Tax returns for the borrower plus the business.

- Business lender statements or other records in the company bank account.

- Understanding how much our home is really worth will help you to meet the requirements to possess a mortgage.

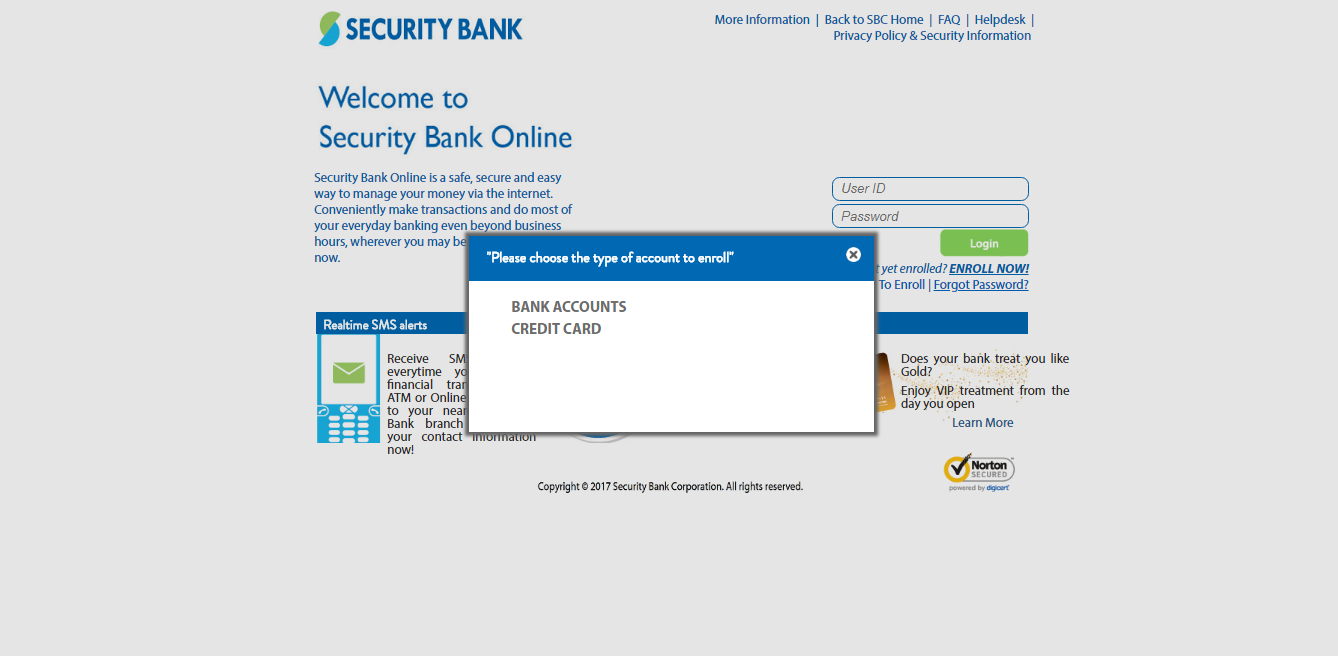

Now, its popular to possess banking institutions to simply accept digital models of them documents, and it may feel easy for that loan administrator locate any of these data files themselves. Including mention, you can examine in case your state was a good notary file state, and so the data you submit to the lender should be notarized.

Exactly how many days away from financial comments would mortgage brokers need?

How far right back a possible borrower’s bank statements have to go can be private loan providers. Yet not, its typical for loan providers to inquire of for up to an excellent year’s value of statements, and the most useful pricing are often arranged getting consumers who can provide 24 months‘ value of comments.

How can lender report financing really works?

What is very important that underwriters need are a consistent reputation for earnings. Especially, they truly are trying to see if you will find sufficient currency to cover the latest proposed the fresh mortgage repayments. You will need to note that most banking institutions cannot proper care how often earnings arrives in the membership. They’re going to generally take the typical more than period or good 12 months to decide the typical level of monthly or every quarter money. It earnings number has to be at least 3 or 4 times higher than new advised repayments towards the home loan.

Business bank statements and private bank statements may be requested, according to brand of financial that is getting taken out. There are many different a few when choosing home financing and in the event the a corporate is regularly give guarantee, statements about team may be required. In these cases, the loan lender will be lookin not just at the earnings in the providers but also the company expenditures.